Welcome to my Week 20 NHL Betting Report, featuring my

Gambling Power Rankings, results by category, my best bets, and my best/worst

teams to bet on or against. It should be noted that I’m not betting with real

money. These are all fictional wagers in a spreadsheet. If you’re betting with real

money, you should not be betting on every single game, only the games you like

the most. Whereas I’m betting on every game, every over/under, because it

provides a complete dataset for macroeconomic analysis. If you followed my

weekly reports last season, one upgrade is that I’m now logging alt pucklines

for every game, favorites +1.5 goals and underdogs -1.5 goals. Click here to

see my Week 19 Betting Report or check out my 3rd Quarter Report for more big picture analysis.

If you’re looking for a big picture commentary on the

last 3 years of hockey betting, you should check out my new book; breaking it down by team, by category, by strategy, by season. There is

plenty of useful information for bettors of all skill levels. It covers

pre-pandemic, peak-pandemic, post-pandemic. What worked, what failed. Lessons

learned, market trends, team-by-team analysis. What impact did the pandemic

have on hockey betting? The market differences between these 3 seasons are

discussed at length, and there's a lot to talk about. To read more, visit

the Amazon

store.

My Weekly Profit: -$452

My Season Profit: $15,995

This NHL trade deadline was among the most entertaining

in recent memory with an insane amount of player movement, but that extraordinary roster volatility

kicked my ass this week. My pick decisions are made after consulting several

different algorithms, but the data feeding them has been tainted, especially

for those teams that made the most moves. They’ll be begging me to bet Chicago

for at least a few more weeks, as oddsmakers will surely start charging very

expensive prices to buy their opponents. I might just bet them to lose all

remaining games by at least 2 goals for the rest of the schedule, regardless of

what the formulas recommend.

Or perhaps I’ll need to revert to my October method of

going 100% on gut instinct and not consulting any algorithms, because there are

already several teams where I no longer trust the numbers. The biggest issue

specifically will be trusting underdogs until we get a little more data with

the post-deadline rosters. One thought that’s crossed my mind is that so much

talent moving from bad to good teams might create an opportunity for overs if

there are more blowouts, but also, many of the non-playoff teams who unloaded

meaningful talent are going to find it harder to score goals. Other teams might

score more, but others will score less.

Looking back at last season and comparing the 2 weeks

heading into the trade deadline versus the 2 weeks after, there was a 4%

increase in goal scoring, but that only led to 2 additional overs because they

had already been booming. Favorites did improve from a 61% win % up to 67%, and

betting $100 on every moneyline would have lost you -$329

pre-deadline versus +$218 profit post-deadline. The lines on favorites also

grew more expensive, from -188 on average to -209. With even more teams tanking

more aggressively, we should see a bigger price swing in 2023.

There has indeed been an uptick in scoring the last 7

days. Scoring had been trending up until a downtick last week in the build-up

to the trade deadline, but it resumed its previous course. For the last 2 weeks

oddsmakers set the over/under totals at almost perfect equilibrium, where you

would have lost money betting either side every game (overs went 25-24-4). My

performance this week betting over/under was embarrassing, but the volatility

created by this magnitude of roster movement is a plenty adequate excuse for my

loss.

My two worst categories were overs, followed by

unders. Frankly, my results would have been significantly better by simply

betting one or the other in every single game. I’m not going to lose any sleep

tonight over this embarrassing performance, because trade deadline roster

volatility is a plausible scapegoat. It’s not my fault (insert Robyn Williams

meme from Good Will Hunting). I owe a debt of gratitude to Minnesota unders,

Tampa overs, and Buffalo overs; otherwise this could have been much worse.

Losing nearly -$1,200

on over/under is demoralizing, but -$800 came

from Chicago and Ottawa, on whom my algorithm went 0-7-1. Chicago overs had hit

in 4 of 6 then swung back to unders going 2-1. There was some bad luck at play in those Ottawa games, as I was within

about 2 goals of breaking even. They played the Red Wings twice who had been a

low scoring team then had high scoring games. Those Ottawa Senators are among the hottest teams

in the league winning 8 of their last 11 games, and they even added pieces at

the trade deadline.

Public Service Announcement! The Tampa Bay Lightning

have lost 5 in a row, getting outscored 11-27. I sustained a big loss for 2 of

those (vs Pittsburgh and Florida), but won a chunk of that back thanks to

Carolina and Buffalo. Tampa was the most profitable team to bet against this

week, with Detroit and San Jose (who went a combined 0-8) as the runners up.

The Red Wings played 5 games and lost them all. San Jose has held the top spot

in my Power Rankings for 7 consecutive weeks, and that’s not because I’m

betting them to win hockey games.

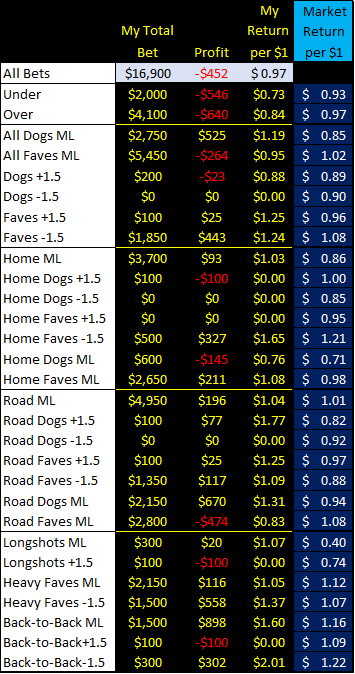

My Week 20 Results

*Note* “Market Return” is based on betting exactly

$100 on every outcome.

This proved to be a stunningly good week to bet road

teams, at least Monday to Thursday. Had you bet $100 on every visitor moneyline

for the first 4 days of the week, you banked $1,037. Then home teams went 15-7 Friday

to Sunday (betting $100 on each netted $522). I have mused in recent reports

that it might be worth investigating home-road splits by day of the week on the

theory that fans have greater impact on the weekend, and it might be time for a

deep dive. This thought experiment was born from starting my betting reports on

Friday, finishing on Sunday, and having to re-write home-road analysis.

I had a strong week betting road underdog moneylines,

but underdog moneyline was a bad category overall. I’m pessimistic about dogs

post-deadline, given the magnitude of how much talent was transferred from bad

to good. As mentioned above, we did see a post-deadline increase in the rate of

return on favorites last season, but you can expect expensive line prices. Last week I

reported losing money shorting back-to-backs (after fantastic 2nd and 3rd

quarters), but they were back on top of my category leaderboard 7 days later

(banking $1,200 on the moneyline and -1.5 goals combined).

We also saw regression in the longshot demographic

this week, which was entirely predictable. I openly questioned their

sustainability in my previous report, citing the trade deadline and teams like

Chicago and Arizona selling everything that wasn’t nailed down. The deadline

was on Friday, but a bulk of the transactions were made days in advance.

Chicago has now lost 4 in a row, San Jose 5 in a row, Columbus and Arizona 2 in

a row. We’re already seeing the worst teams get worse. The Ducks have won 4 of

their last 5, but are now without Kulikov and Klingberg.

My Team of

the Week: Minnesota Wild, +$714

As appallingly bad as my over/under performance was

this week, one team that did deliver was the Minnesota Wild. Their unders went

3-0 and continued their scorching hot run, which is now at 16-1-1 in their last

18 games. The Wild also won all 3 of their games, and I cashed in on two of

those Ws. This team has been near the top of my Power Rankings for the last 10

weeks and those unders have been a major contributing factor. Minnesota has now

won 8 of their last 9 games, adding some pieces at the deadline, and are

starting to heat up at the perfect time. Note to self.

My next best team of the week was the Arizona Coyotes,

who have now lost 5 of their last 6 games after unloading several pieces

leading up to the trade deadline. I have promoted the Yotes as a value play at

a few different points of the season when they were outperforming their line

price, but in the final stretch I’ll be aggressively betting them to lose. My

biggest windfall in the last 7 days was going “all in” on Carolina (half

moneyline half -1.5 goals), and my gut is telling me to go big on their opponents

-1.5 goals for the rest of the schedule, I’m just nervous about the goalies.

They kept both at the deadline, and either is more than capable of stealing any

given game.

My Worst

Team of the Week: Vegas Golden Knights, -$810

The Vegas Golden Knights may be without Mark Stone and

Logan Thompson, but that didn’t stop them from going 3-1 this week. Jack Eichel

has gone into beast mode and looks like he’ll personally carry them into the

playoffs. The problem from my end is that 2 of those wins were against Carolina

and New Jersey, two teams I’ve been riding hard. “Vegas is frisky” was written

in my game notes for both those matches, but my allegiance to the Canes and

Devils superseded that warning. Vegas was also a casualty of my other strategy

of betting east to beat west as often as possible. They went 3-0 vs the Eastern Conference.

The Florida Panthers were my second worst team of the

week, which started when they lost Barkov and Bennett to injury, prompting me

to lay a $500 bet on Tampa to beat them. The game was in Tampa and the Panthers

are much worse on the road, yet won 4-1 (little did I know the Lightning were

embarking on an 0-5 slump). The Panthers next game was at home against

Nashville, who traded away several players, but the Preds won 2-1. So Florida

beat a really good team on the road, then lost to a bad team at home. That

feels like it’s not my fault.

My 3 Best Market

Bets of Week 20: Overall Best Market Bets of Week

20:

1) Shorting back-to-backs ML: +$898 1) Home favorites -1.5 goals:

+$637

2) Road underdog moneyline: +$670 2) Shorting back-to-back -1.5

goals: +$242

3) Heavy favorites -1.5 goals: +$558 3) Shorting back-to-back

ML: +$179

My 3 Worst Market

Bets of Week 20: Overall Worst Market Bets of Week

20:

1) Overs: -$640 1)

Underdog moneyline: -$755

2) Unders: -$546 2)

Home moneyline: -$724

3) Road favorites moneyline: -$474 3) Road underdog +1.5

goals: -$544

My Best Teams To Bet On In Week 20: Overall Best Teams To Bet On:

(over/under/hedges not included) ($100 ML + $100 PL+1.5

+ $100 PL-1.5)

1) Minnesota Wild: +$498 1) Ottawa Senators: +$1,271

2) Ottawa Senators: +$429 2) Vancouver Canucks: +$709

3) Los Angeles Kings: +$369 3) Florida Panthers: +$610

My Worst Teams To Bet On In Week

20

(over/under/hedges not included)

1) Tampa Bay Lightning, -$850

2) Toronto Maple Leafs, -$600

3) Detroit Red Wings, -$400

My Best Teams To Bet Against In Week

20: Overall Best

Teams To Bet Against:

(over/under/hedges not included) ($100 ML + $100 PL+1.5

+ $100 PL-1.5)

1) Chicago

Blackhawks, +$521 1)

Tampa Bay Lightning: +$1,373

2) Colorado

Avalanche, +$503 2) Detroit Red

Wings: +$1,139

3) Arizona

Coyotes, +$501 3)

San Jose Sharks: +$1,155

My Worst Teams To Bet Against In Week

20:

(over/under/hedges not included)

1) Vancouver Canucks, -$600

2) Vegas Golden Knights, -$593

3) Florida Panthers, -$500

Market’s Best Over/Under Bets In Week

20:

($100 wagers)

1) Ottawa overs,

+$361

2) Florida

unders, +$295

3) Dallas overs,

+$282

Team By Team Power

Rankings

These power rankings are based on the sum of all my bets per team, including

where the money was won or lost. Each week my new Power Rankings will be based

on all the games in the season, not just what happened this week.

No comments:

Post a Comment